By Xander Snyder

Pakistan’s tenuous economic situation is opening the door to foreign competition in the country. Since Islamabad signed on with the China-Pakistan Economic Corridor, the largest project in Beijing’s expansive Belt and Road Initiative, China has spent billions of dollars on the endeavor. And the financing comes with plenty of strings attached. Sri Lanka, for example, had to concede control of Hambantota port, another Belt and Road production, to a state-owned Chinese firm after failing to repay what it owed for the project. Though Pakistan hopes to avoid the same fate, doing so won’t be easy. To fend off downward pressure on its currency, the rupee – which has lost 15 percent of its value this year – Pakistan has had to dip into the foreign exchange reserves it needs to service its mounting obligations. The country, facing a balance of payments crisis, seemed to have no choice but to borrow even more money from Beijing or solicit yet another bailout (its 12th since the 1980s) from the International Monetary Fund.

Then a third option emerged: Saudi investment. In late September, Pakistani Prime Minister Imran Khan announced that Riyadh had agreed to invest in the CPEC. Khan walked back the statement Oct. 3, saying the kingdom would not join the project. Still, he made it clear that plenty of investment opportunities, including infrastructure related to but not technically part of the CPEC, remained available to Saudi Arabia in his country. The oil-rich Gulf state’s funding would help ease Pakistan’s financial woes and discomfort at its growing dependence on China, while also promoting Saudi and U.S. interests in the region.

Buying Time for Islamabad

Choosing between an IMF and a Chinese loan is tricky for Pakistan. On the one hand, taking money from China would increase Islamabad’s reliance on and debt to Beijing, notorious for its tendency to raise interest rates when borrowers come back asking for more. On the other, requesting help from the IMF would probably entail greater transparency on Pakistan’s part, for instance over its debt deals with China. That transparency – something China has avoided in all of its infrastructure projects around the world – could damage Islamabad’s relations with Beijing. It could even provoke domestic backlash if the Pakistani public found the CPEC deals’ terms too favorable to China. Despite these risks, however – and despite reluctance from the IMF’s second-largest vote-holder, the United States, to follow through on a loan – Khan approved negotiations on Oct. 10 with the global lender. Islamabad has also accepted a few smaller loans from China to keep it afloat in the meantime.

Assistance from Saudi Arabia would give Pakistan a little more breathing room. The prospective agreement between them is believed to include a $2 billion bridge loan, along with a deal for Pakistan to buy between 110,000 barrels per day and 200,000 bpd of crude oil from the kingdom on 90 days’ credit, a generous arrangement. (For comparison’s sake, consider the 60 days’ credit Iran extended to India in what was regarded as a buyer-friendly deal.) The deferred payments plan would be especially important to Pakistan because it would enable Islamabad to stem foreign reserves outflows without restricting its access to oil imports, thereby easing some pressure on the Pakistani rupee. Furthermore, though Pakistan is expected to use the crude from Saudi Arabia initially to meet its domestic needs, the extended payment plan would give it enough time to refine and sell some of the oil to China for a profit before reimbursing Riyadh. Saudi Arabia probably wouldn’t mind, so long as Islamabad keeps buying more of its crude oil. After all, every barrel Pakistan sells to China is one less barrel for China to buy from Iran.

And that’s not all Riyadh stands to gain from lending Islamabad a hand. In exchange for funding, for example, Saudi Arabia could ask Pakistan to break its neutrality in the Yemeni civil war and lend support to the coalition fight against the Houthis, whom Iran sponsors. A purported investment in a new oil refinery at the Gwadar port, part of the CPEC, also promises to yield a 16 percent return for the kingdom. In addition, the deal would afford Saudi Arabia access to between 14.5 million and 22 million barrels' worth of storage space where it could house its oil without having to worry about a potential Iranian blockade at the Strait of Hormuz. That way, it could guarantee a more reliable supply of oil to its Asian customers regardless of what happens in the Persian Gulf.

A Mixed Bag for China

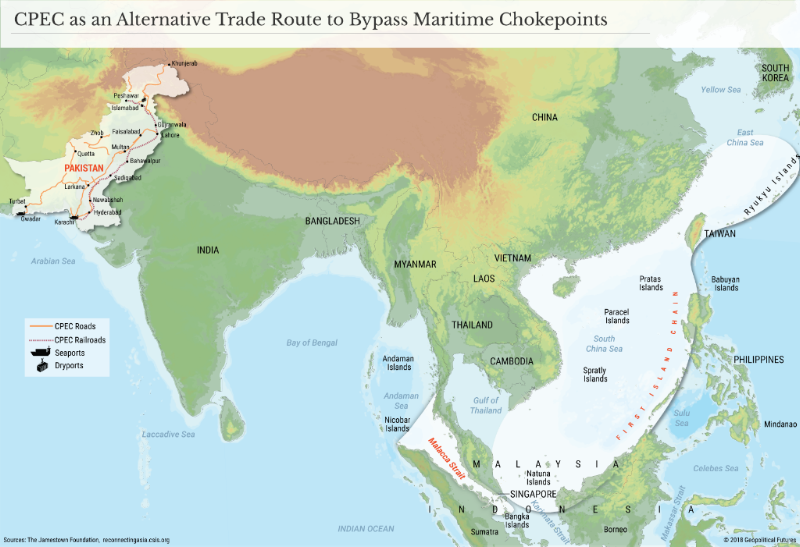

Beijing would welcome better and more secure access to Saudi oil, but it would take less kindly to other aspects of Riyadh’s involvement in Pakistan. If Saudi Arabia invests in infrastructure projects outside the CPEC that are nonetheless integral to the project, such as the refinery, it will undermine China’s control over the transport route, particularly at the ingress point. And for China, control is key. The main goal of the CPEC is to provide the country alternative supply routes so that it can bypass chokepoints such as the Malacca Strait in transporting its goods abroad. The corridor from China through northeast Pakistan to Gwadar port is one such route. (It would also give China access to, if not outright ownership of, another port on the Indian Ocean where it could station military forces down the line.) Saudi Arabia’s participation, however, would introduce an element of uncertainty to China’s authority over Gwadar, and over the CPEC as a whole, since a deal with Riyadh would ease the pressure on Islamabad to heed Beijing’s demands.

China’s concerns notwithstanding, all signs indicate that Saudi Arabia and Pakistan are moving forward with a deal. Pakistani media have reported, citing anonymous officials, that representatives from the two countries are working to finalize memorandums of understanding. To reassure Beijing of Islamabad’s continued commitment to the CPEC, the Pakistani army chief visited China in September and had a rare private audience with President Xi Jinping.

U.S. Gains on a Saudi Investment

If China is wary of the deal, the United States is more enthusiastic. The U.S. has an interest in diminishing Pakistan’s dependence on Beijing. For one thing, China’s growing presence in the Indian Ocean puts India – an emerging partner in Washington’s efforts to contain Chinese expansion – at risk of encirclement. For another, Washington wants to maintain enough clout with Islamabad to facilitate its efforts at rooting out jihadist organizations operating in Pakistan. The more Pakistan depends on it or its allies, the more effective the U.S. can be in this endeavor. Above all, the United States’ goal for Pakistan is to keep the country stable and prevent its nuclear weapons from falling into the wrong hands. The investment Riyadh reportedly has offered Islamabad would serve those objectives by helping to stave off economic collapse.

That Saudi Arabia’s deal with Pakistan would put pressure on Iran is an added bonus for Washington. Given the choice, China will opt to buy Saudi oil, rather than continue to risk the supply chain disruptions entailed in importing Iranian oil that must transit chokepoints as it crosses the Indian Ocean. Saudi Arabia, moreover, may choose to exclude Iran if it secures control of the new refinery and gets a say over which countries may transport oil through Gwadar port.

Beyond the economic implications, the Saudi investment in Pakistan would also have geostrategic and security ramifications for Iran. Tehran doubtless fears that with its greater involvement at Gwadar, Riyadh will station its own or its allies’ naval forces there – too close for comfort to the Chabahar port. Chabahar, a joint project with India, has been a boon for Iran, offering the country a way into the Indian Ocean from beyond the Persian Gulf. Should Saudi Arabia demand greater military cooperation from Pakistan in return for its assistance, the kingdom could turn the tables on Iran and threaten its access to the ocean. Closer to home, meanwhile, a Saudi presence in Gwadar could fuel the Sunni jihadist insurgency in Iran’s neighboring Sistan and Baluchestan province. Many of the restive province’s militant groups subscribe to the Wahhabi version of Islam prevalent in Saudi Arabia, and the kingdom could use its activities at Gwadar to more easily finance or even equip them. Just as Tehran has threatened Saudi Arabia’s southern border by supporting Yemen’s Houthi rebels, Riyadh could menace Iran’s eastern border by backing the Sunni insurgents in Sistan and Baluchestan.

The range of economic and geostrategic effects that Saudi Arabia’s involvement in Pakistan would produce suggests that the United States played a part in brokering the deal. The arrangement promotes Washington’s efforts not only to put the squeeze on Iran, but also to lure Pakistan away from China.

But the U.S. would hardly be the agreement’s only beneficiary. The prospective deal, of course, will help Pakistan, too, bringing in more money to offset its growing debt payments and perhaps enabling it to draw in more foreign currency through refined oil exports. Saudi Arabia stands to gain a large oil storage facility in better proximity to its Asian customers and a cut of whatever profits the new refinery at Gwadar generates. What’s more, it could secure Pakistan’s military assistance in the Yemeni civil war if it makes that demand of Islamabad, and if the Pakistani government agrees. For China, however, the improved access to oil that the deal may afford it would come at the cost of control over the Belt and Road Initiative’s largest project.

No comments:

Post a Comment