Mark Gongloff

Mark Gongloff is an editor with Bloomberg Opinion. He previously was a managing editor of Fortune.com, ran the Huffington Post's business and technology coverage, and was a columnist, reporter and editor for the Wall Street Journal.

Mark Gongloff is an editor with Bloomberg Opinion. He previously was a managing editor of Fortune.com, ran the Huffington Post's business and technology coverage, and was a columnist, reporter and editor for the Wall Street Journal.

The most-read story on the Bloomberg Terminal today is about how two big Chinese companies apparently failed to make key debt payments this month, as bond defaults and corporate failures surge across the country. This is happening while trade negotiators are in Beijing trying to hammer out a deal to avert big U.S. tariffs on Chinese goods starting next month. J. Kyle Bass and Daniel Babich of Hayman Capital Management – the hedge fund that made big, correct bets on subprime mortgages ahead of the crisis – write this is a golden opportunity for President Donald Trump to wring concessions from China.

The trick, though, is for Trump to get the right concessions; if China simply agrees to buy more American stuff, then that might give Trump a short-term “win” and calm the stock market, but it won’t make a lasting difference, Kyle and Daniel write. What’s really needed are substantive changes in how China does business, particularly its preferential treatment of its own companies and hostility toward foreigners, they write. Does Trump realize this?

In an effort to bolster its economy, China has opened the door wider to foreign investment. But this is a sign of desperation and won’t help, writes Christopher Balding. Capital is fleeing China because it’s a structurally dicey place to invest, not because of any artificial caps (which aren’t being met anyway), he writes. China needs real market reforms before it can attract foreign capital again, Chris writes.

Further Trade Reading: A bill to give Trump the power to enact tit-for-tat tariffs is wrongheaded and could crush free trade and economic growth. – Ramesh Ponnuru

Iran’s Revolution Turns 40

Forty years ago today, Ayatollah Ruhollah Khomeini took power in Iran, capping a revolution that toppled the corrupt regime of the U.S.-backed shah. It’s traditionally a time of celebration, but now it’s a moment for Khomeini’s successors to think about how far astray they have led their people, Bloomberg’s editorial board writes. The country is slipping backwards economically, isolated from its neighbors and the rest of the world. Little wonder its leadership is increasingly unpopular. The solutions may be bitter medicine, but they’re worth taking, the editors write.

That may not go far enough for Eli Lake, who writes it’s time for a democratic revolution in Iran. Khomeini’s promises were lies, and the current regime is just as corrupt, oppressive and inept as the shah was, Eli writes.

Further Iran Anniversary Reading:

The Arab world blames Iran for its problems, but it would be a mess with or without Tehran’s help. – Hussein Ibish

Iran’s revolution was not about raw “Muslim rage” but something more familiar to Westerners. – Pankaj Mishra

Reconsidering the Green New Deal

The Green New Deal rollout maybe could have gone more smoothly. The office of co-sponsor Alexandria Ocasio-Cortez briefly released an “FAQ” about it that led some, including our own Noah Smith, to criticize it as wildly unrealistic. But the FAQ is gone. And the actual letter of the GND is not meant to be a fully fledged list of policies ready to be enacted, but the opening battle cry of what will be a long and difficult struggle, Liam Denning writes. Calling it unrealistic misses the point.

Karl W. Smith agrees the GND is a manifesto and puts it into historical perspective: It marks the end of a decades-long era of liberalism in retreat. It’s an unabashed embrace of big government and the latest sign a growing voting demographic is turning left, Karl writes.

Further Big-Government Reading:

Economic consensus is moving away from austerity toward a belief that a manageable level of government debt is fine. – Noah Smith

A Finnish experiment in universal basic income suggests it makes people happier, but not inclined to look harder for work. – Leonid Bershidsky

Warren Pays the Price of Progress

Not long ago, it wasn’t all that odd for white people to claim Native American ancestry; Bill Clinton, for example, claimed to be one-eighth Cherokee, and nobody batted an eye, notes Francis Wilkinson. It was a form of white privilege we now understand to actually be cultural appropriation. That is progress, Frank writes, but this new standard might also cost the Democrats one of their most talented politicians in Elizabeth Warren.

Telltale Charts

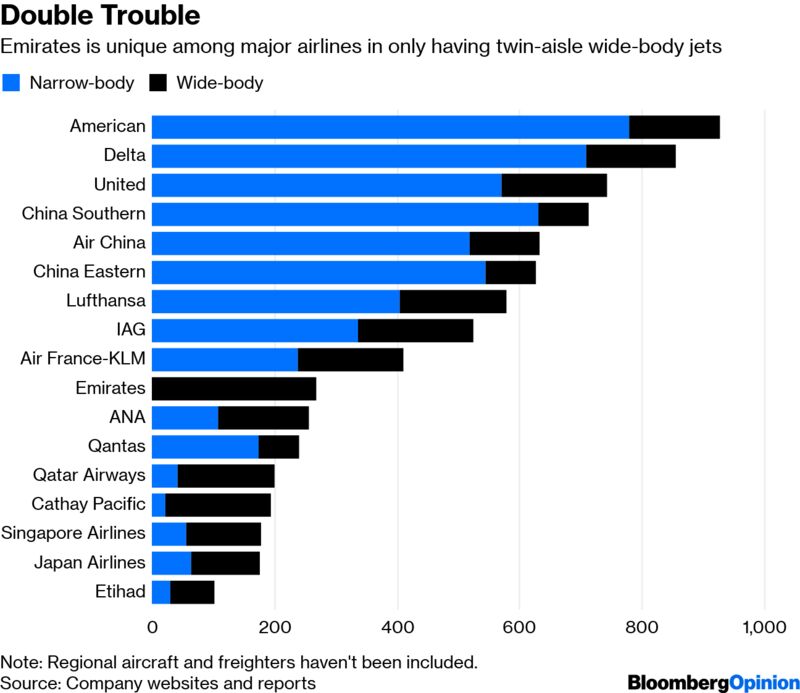

Emirates tied its fate to the ginormous A380, a plane whose time seems to have passed, writes David Fickling.

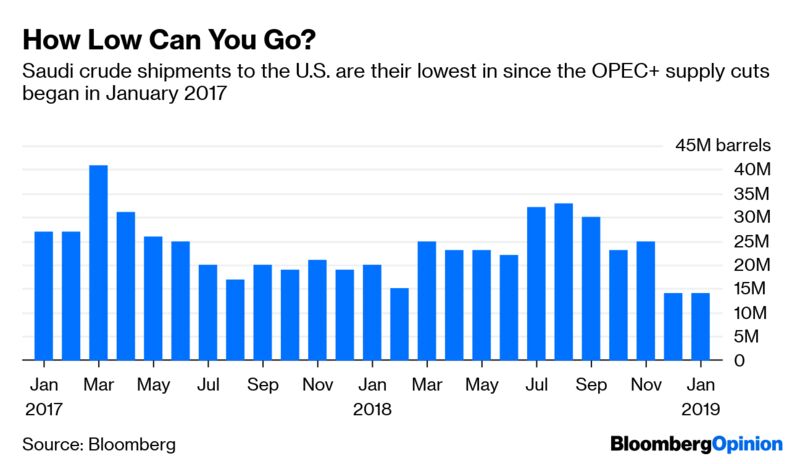

Oil supply seems to be tightening dramatically, but the price effect could be swamped by sinking demand, writes Julian Lee.

Further Reading

European regulators were right to nix the Siemens-Alstom deal; the EU needs competition more than industrial giants. – Bloomberg’s editorial board

You can save bicyclists’ lives with this one weird trick. – Bloomberg editorial board

A decade of post-crisis data show banks with more capital generally lend more, contrary to what they have warned. – Mark Whitehouse

Here are four reasons the Fed’s next shift will be into neutral or reverse. – Mohamed El-Erian

The struggle in Venezuela is the centerpiece of a new Cold War involving Russia, China and the U.S., and Trump has made it harder to win. – Hal Brands

No comments:

Post a Comment