Sheridan Prasso

Only the sink remains along what was once an outer wall of Fernando’s seafront home on the west coast of Sri Lanka, about 20 miles north of Colombo. Part of his thatched-roof house where the 55-year-old fisherman has lived for three decades suddenly washed away last year. The dredger he blames, like a mythological sea monster ceaselessly sucking the sea bed, is visible in the distance as he speaks. Waves used to wash sand in, he says, but now they only wash it out, tearing away the shoreline—a charge government officials deny. “From the taking of sand,” Fernando says, “everything is being destroyed.”

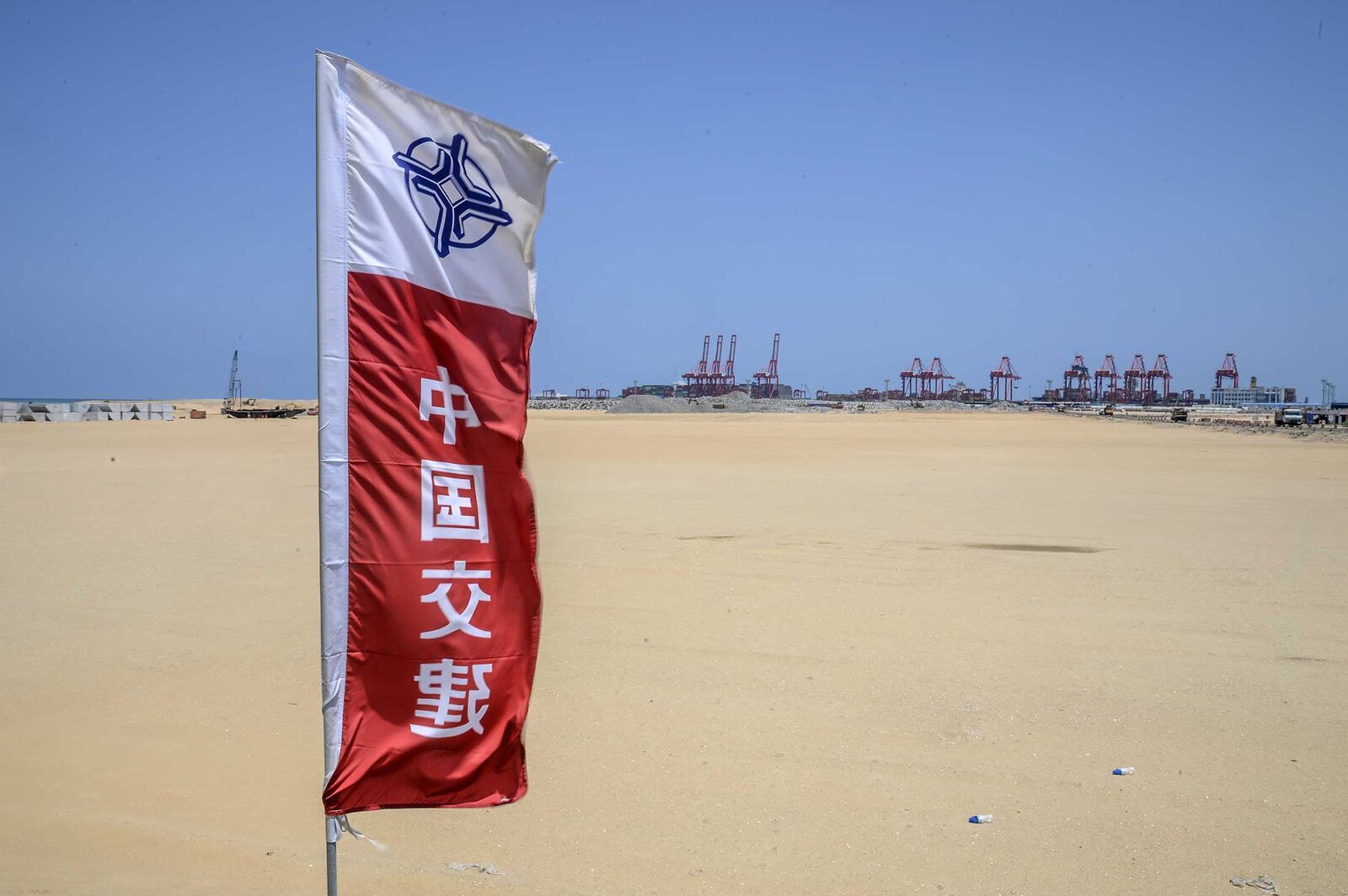

The sand is being dumped along the coast of Colombo’s business district, where it covers an area the size of 500 American football fields and weighs as much as 70 million Toyota Camrys. It’s the foundation of a development known as Port City Colombo being built by China Communications Construction Co., or CCCC. Plans envision a financial district—pitched as a new hub between Singapore and Dubai—with a marina, a hospital, shopping malls, and 21,000 apartments and homes. The project is part of China’s Belt and Road Initiative, an ambitious plan announced in 2013 by President Xi Jinping to build an estimated $1 trillion of infrastructure to support increased trade and economic ties and further China’s interests around the globe.

State-owned CCCC, one of the world’s largest companies with annual revenue greater than Procter & Gamble Co. or FedEx Corp., says its portfolio of 700 projects in more than 100 countries outside China has a value of more than $100 billion. That makes it the largest Belt and Road contractor, according to RWR Advisory Group in Washington, which tracks Chinese investments abroad for government and corporate clients.

It is also one of the most vexed. CCCC and its subsidiaries have left a trail of controversy in many of the countries where they operate. The company was blacklisted by the World Bank in 2009 for alleged fraudulent bidding practices on a highway contract in the Philippines. Malaysia halted two rail projects this year amid corruption suspicions. In Australia, a government investigation published in March said that a CCCC-owned company may have been lax in supervising construction of a children’s hospital, where the water supply was tainted with lead and a subcontractor installed asbestos-filled panels—problems CCCC said weren’t its fault.

The Colombo project has drawn protests over environmental issues and is dogged by worries about the types of businesses it will attract, its governance under a legal structure separate from the rest of the country, and the strain that such a huge development will place on surrounding transport, water, and energy infrastructure.

The list goes on: allegations of mistreatment of railway workers in Kenya and of corruption in Bangladesh. In Canada, the company was blocked in May from acquiring a construction firm on national security grounds. And there have been calls by some members of the U.S. Congress to sanction CCCC because of its alleged role in helping the Chinese military build bases on reefs along a disputed area of the South China Sea—an issue that scuttled the company’s plans in 2015 to raise $1 billion by spinning off its dredging unit in a public offering on the Hong Kong stock exchange.

There’s no shortage of companies, including American ones, that have been accused of bribery and environmental damage when operating abroad. Yet the number and scope of allegations involving CCCC set it apart. “CCCC seems to be constantly pressing the envelope of how countries feel about having a foreign state-owned entity involved in their most strategic assets and critical infrastructure projects,” says Andrew Davenport, RWR Advisory’s chief operating officer. “Recent controversies involving certain of their projects have not helped.”

In an interview with Bloomberg Television at CCCC’s Beijing headquarters in August, Chairman Liu Qitao said changes in government in countries where the company has projects often bring forth accusations of corruption. Liu said CCCC complies with local laws and environmental regulations in all countries where it does business. It also monitors adherence to internal guidelines, he said. Liu wouldn’t comment on what, if anything, the company is doing in the South China Sea.

“We do not allow, nor is there any, corrupt behavior related to any official, because we know that this kind of corrupt behavior is not going to help with the company’s sustainable development,” the 61-year-old chairman said. “And we, as a listed company, are subject to market supervision. If there is corrupt behavior, then the company is finished.”

CCCC is a mashup of several engineering, dredging, and construction companies, two of which date back to the Qing dynasty around the beginning of the 20th century. Another got its start as the road building division of the People’s Liberation Army during the civil war that brought the Communist Party to power in 1949.

In 2005, the government merged two state-owned entities, China Harbour Engineering Co. and China Road and Bridge Corp., to create CCCC and arranged a listing on the Hong Kong exchange. Today, the company has more than 60 subsidiaries and 120,000 employees, according to its website. Most of its projects are in China, and many investments have nothing to do with Belt and Road. CCCC owns an oil-rig design firm in Texas, and one of its real estate units is co-developer of the Frank Gehry-designed Grand Avenue project in Los Angeles.

Despite the company’s global presence, its chairman keeps a low profile and rarely grants interviews to Western media. Trained as a hydraulic engineer at Dalian University of Technology, Liu worked for years at Sinohydro Group, which built the Three Gorges Dam, before becoming president of CCCC in 2010. His official salary was about $120,000 last year, which is in line with those of top executives at other state-owned enterprises.

At most such companies, the Communist Party occupies a central place in the leadership structure, and it’s no different at CCCC. Liu is party chief as well as head decision-maker. In one speech published on a government website, he speaks of turning CCCC into a reliable executor of the party’s vision.

Dressed for the Bloomberg interview in a charcoal pinstripe suit and red tie, his hair combed back, Liu said the Belt and Road Initiative was “proposed by Mr. Xi Jinping based on the concern for the development of mankind, and it invites participation from everyone, not just China but Western companies as well, and aims for shared gains through consultation and cooperation.”

By the late 2000s, when China’s economy showed signs of stalling, CCCC began scouting for opportunities in Southeast Asia and Africa. But it ran into a roadblock in the Philippines when a World Bank investigation concluded that a CCCC road building subsidiary was one of seven companies involved in “a collusive scheme designed to establish bid prices at artificial, non-competitive levels” in an auction for a highway contract. The organization blacklisted CCCC in 2009, a ban that lasted eight years. The company said at the time that the allegations had no merit and it had complied with all regulations.

The year the World Bank ban went into effect, the same CCCC road building subsidiary allegedly paid $19 million to a son of the president of Equatorial Guinea to win a highway contract, according to a U.S. asset-forfeiture case filed in Los Angeles in 2013. The lawsuit says some of the money, combined with other ill-gotten gains, was used to purchase Michael Jackson memorabilia, including a signed Thrillerjacket and a white, crystal-covered Bad World Tour glove. The president’s son settled the case, agreeing to hand over $30 million worth of properties (not including the jacket and glove). CCCC declined to comment.

The Belt and Road Initiative gave the company a pipeline of new projects, as both Chinese commercial lenders and the government stepped up with financing. Loans from the Export-Import Bank of China and the China Development Bank meant CCCC didn’t have to rely on Western institutions such as the World Bank to fund ports and railroads. Chinese financing also sped up the process of getting complex infrastructure projects off the ground.

As the company’s footprint grew, so did the controversy. Investigators in Malaysia are looking into whether CCCC overbilled for a railroad linking Kuala Lumpur with east coast cities, and whether some of that money went to pay debts incurred by government development fund 1Malaysia Development Bhd., during the administration of former Prime Minister Najib Razak, who’s facing trial on corruption charges. In Bangladesh, the finance minister told reporters in January that CCCC was blacklisted from future projects after allegedly bribing an official involved in awarding a contract to build a 140-mile highway.

Liu said the suspension of rail construction in Malaysia was the result of a change in government this year, that the cost is in line with similar projects, and that he hopes work will resume because it “means a lot for the development of Malaysia.” The allegations of bribery in Bangladesh were a “mistake,” he said. “We are still doing work in Bangladesh. We are not on the blacklist.” Finance ministry officials in Bangladesh didn’t respond to requests for clarification.

Building the Belt and Road

Chinese construction company CCCC has infrastructure projects across Asia, Africa, and Latin America

Data compiled by RWR Advisory Group, a Washington-based research firm that tracks Chinese investments abroad based on media reports, corporate disclosures, regulatory filings, and in-country sources. CCCC projects, represented by circles on this map, are sized by dollar value. They include only projects that have been completed or initiated outside China since 2012 for which a project value could be ascertained. In certain cases, these values may reflect awards to groups of companies or joint ventures in which CCCC was a part. Canceled or pending transactions aren't included. As RWR research reflects only what has been publicly reported, errors and omissions are possible.

The lure of Chinese money is hard to resist for poor countries in Asia and Africa. It’s the cheapest and fastest way to turbocharge an economy, says Sumal Perera, founder and chairman of Sri Lankan construction company Access Engineering Plc, which has worked with CCCC on a number of projects, including building apartments for Port City engineers and technicians. “To work with the Chinese is to be in the fast lane,” Perera says. “I can’t believe state-owned companies have so much dynamism and initiative.”

The hazards of being in the fast lane are obvious in Sri Lanka. In 2010, before there was a Belt and Road Initiative, then-President Mahinda Rajapaksa was seeking to spark development in Hambantota, his rural home district on the island’s south coast, a four-hour drive from Colombo. CCCC subsidiary China Harbour was awarded a contract to build a port in Hambantota, and in 2014 it was granted the Colombo project as well. Now corruption allegations are swirling.

In July, Prime Minister Ranil Wickremesinghe said authorities are investigating $8.1 million in fund transfers to members of Rajapaksa’s staff during the six weeks before the January 2015 election, when Rajapaksa was running for a third term. The prime minister said the amount included payments from CCCC routed through an account at Standard Chartered Plc.

Foreign contributions to political campaigns are not prohibited in Sri Lanka, and Rajapaksa, who lost his re-election bid in part because of voters’ opposition to the Chinese projects, has denied any wrongdoing. CCCC dismissed as “speculation” that its money funded the campaign, and the Chinese embassy in Colombo issued a statement saying Chinese projects in Sri Lanka adhere to the principles of “extensive consultation, joint contribution, and shared benefits.”

The winner of the 2015 election, Maithripala Sirisena, warned on the campaign trail that Sri Lankans “would become slaves” to the Chinese if the projects went ahead, and he quickly shut them down once he took office. But he restarted both a year later, with even bigger footprints.

His administration invited another state-run port operator, China Merchants Port Holdings Co., to bid against CCCC for resuming construction at Hambantota. China Merchants won the contract after wowing the government with a presentation about making the port like one it built in Shenzhen, China, according to Saliya Wickramasuriya, a senior adviser to both the Hambantota and Colombo projects. As compensation for the switch, he says, CCCC got a tentative commitment for 15,000 acres surrounding the Hambantota port to develop as an industrial zone.

Today, Hambantota handles about one ship a day, not enough to make it commercially viable, and wild elephants regularly breach the perimeter fencing. At a nearby airport, which CCCC also helped build during Rajapaksa’s administration, the only commercial flight was canceled in June because of frequent peacock strikes and low demand.

The government also renegotiated the Colombo project, seeking to address the issues that opposition politicians had raised. It dropped plans for a Formula One racetrack, gave CCCC a 99-year lease instead of outright land ownership, and drafted more than 70 environmental impact-mitigating requirements. It also increased the land area by 15 percent.

The vision for Port City Colombo seems in part an answer to a problem that has long plagued Sri Lanka: Its $90 billion economy doesn’t generate enough employment, which is why the country is a net exporter of labor. Marketing plans tout the 80,000 new jobs the project will create, while computer renderings show 90-story luxury apartment towers, shopping malls, state-of-the-art health-care facilities, and fancy schools, all meant to reverse a brain drain of white-collar workers. Meanwhile, the multimillion-dollar, two-story homes that will line an artificial beachfront and a private marina are designed to lure the wealthy of Karachi, Mumbai, Delhi, and Dhaka—and rich Chinese, too.

“We lost our opportunity to Dubai and Singapore, and now we are trying to catch up,” says Champika Ranawaka, who heads Sri Lanka’s Ministry of Megapolis and Western Development, one of two government agencies involved in approving the Colombo project. He says CCCC is putting up all of the $1.4 billion for the initial phase of construction, which the company says is 70 percent funded by loans from Chinese banks at commercial rates. That, plus an additional $800 million that CCCC is spending to build connecting roads, gives it the right to develop most of the land at Port City to recoup its investment, Ranawaka says. “They’re taking a risk, so they have to somehow earn their money. Their success creates a lot of other opportunities for Sri Lanka.”

The government intends to ring-fence Port City from Sri Lanka’s legal system to facilitate currency movement and create favorable tax and investment incentives. Harsha de Silva, a state minister who once campaigned against the project but is now one of its most vocal supporters, is involved in drafting the separate legal structure. “This must be a top-10 city for doing business in the world,” he says. “Otherwise, what’s the point?” Sri Lanka is currently ranked 111 out of 190 nations on the World Bank’s ease-of-doing-business index.

Opponents of Port City see dangers. They say laws encouraging capital flows will make Sri Lanka a financial bottom feeder, a haven for hidden assets such as India’s so-called black money stashed abroad to avoid taxes. They fear casinos will move in and create the only gambling hub in South Asia—something government officials deny but may not be able to prevent. They’re worried about rising pollution levels and how Port City will get enough water and power. And they question whether the project, which has no committed investors, is a pie-in-the-sky vision of a future that won’t materialize.

“The whole deal is rotten to the core,” says Feizal Mansoor, a member of the People’s Movement Against the Port City, a group of environmentalists, fishermen, clergy, and other opponents. The sand and quarried rock used for the landfill is 100 years’ worth of construction resources being used up at once, he says, and the Chinese should be paying for it. “They’re going to make a 100 percent profit on their capital investment, and we’re going to make a 1,000 percent loss.”

The biggest cost so far is the environmental damage along a 175-mile stretch of coastline north and south of Colombo and the impact on 80,000 households that make a living from the sea. Sri Lanka’s Environmental Foundation warned two years ago that building Port City would have a “severe and highly detrimental” impact on the coastline, causing erosion and affecting marine biodiversity, fishery stocks, and breeding sites.

Government officials issued a 421-page environmental impact assessment before the project was restarted, stating that studies “clearly establish” that it won’t cause erosion. The report conceded that dredging would temporarily disrupt some fishing grounds and directed CCCC to pay $3.2 million to fund community projects in the affected areas. But officials say that they’re following mitigation guidelines and that critics don’t have any proof to substantiate their claims.

A hunger strike by fishermen in 2016 resulted in an agreement forcing the dredgers farther offshore. But that has barely helped, says Herman Kumara, head of the National Fisheries Solidarity Movement, which represents 17 organizations and unions in Negombo, the center of the fishing industry, north of Colombo. He disputes statistics compiled by Port City officials showing that fishermen’s livelihoods have improved and that fish catches are up. “This is destroying the coast and the coral reefs, and the sea erosion is very serious,” Kumara says.

Travel up the coast and you hear fishermen talk about a 20 percent decline in catch and hardships that threaten to wipe them out. “Our future is now being destroyed,” says Aruna Roshantha Fernando, the president of the All Ceylon Fisher-folk Trade Union and a leader of the hunger strike, who brought an unsuccessful petition to the Supreme Court seeking to stop the Colombo project. “We ask them: If somebody destroys our livelihood, what is your responsibility? They don’t answer.”

Mervin Thamel, secretary of the Indiwara Fisheries Cooperative Society just north of Negombo, says that herring, which used to be plentiful and breed where Port City is going up, are nowhere to be found. “We had to sell our gold” to buy fuel to keep the fishing boat operating farther and farther out to find fish, says Thamel, sitting on his front porch a few blocks from the sea. “We’ve protested a lot,” he says, “but we couldn’t stop it.”

On Christopher Fernando’s stretch of beach, south of Negombo, his next-door neighbor, W. Mary Johanna, laments the loss of two coconut trees that recently washed out to sea. Since she was born here 52 years ago, she says, she never had a problem with erosion—until the dredgers showed up. Now she’s piling up garbage to stop the waves crashing in on her property, where more than 700 square feet have washed away. “It’s difficult to push against the government; they won’t admit they’re causing this,” she says. “What else can we do apart from die? Soon, I’ll just be washed out with the sea.”

—With Anusha Ondaatjie, Dong Lyu, Arun Devnath, Yudith Ho, John Liu, Iain Marlow, Jinglun Zhang, and Cathy Chan

No comments:

Post a Comment