SIMON JOHNSON

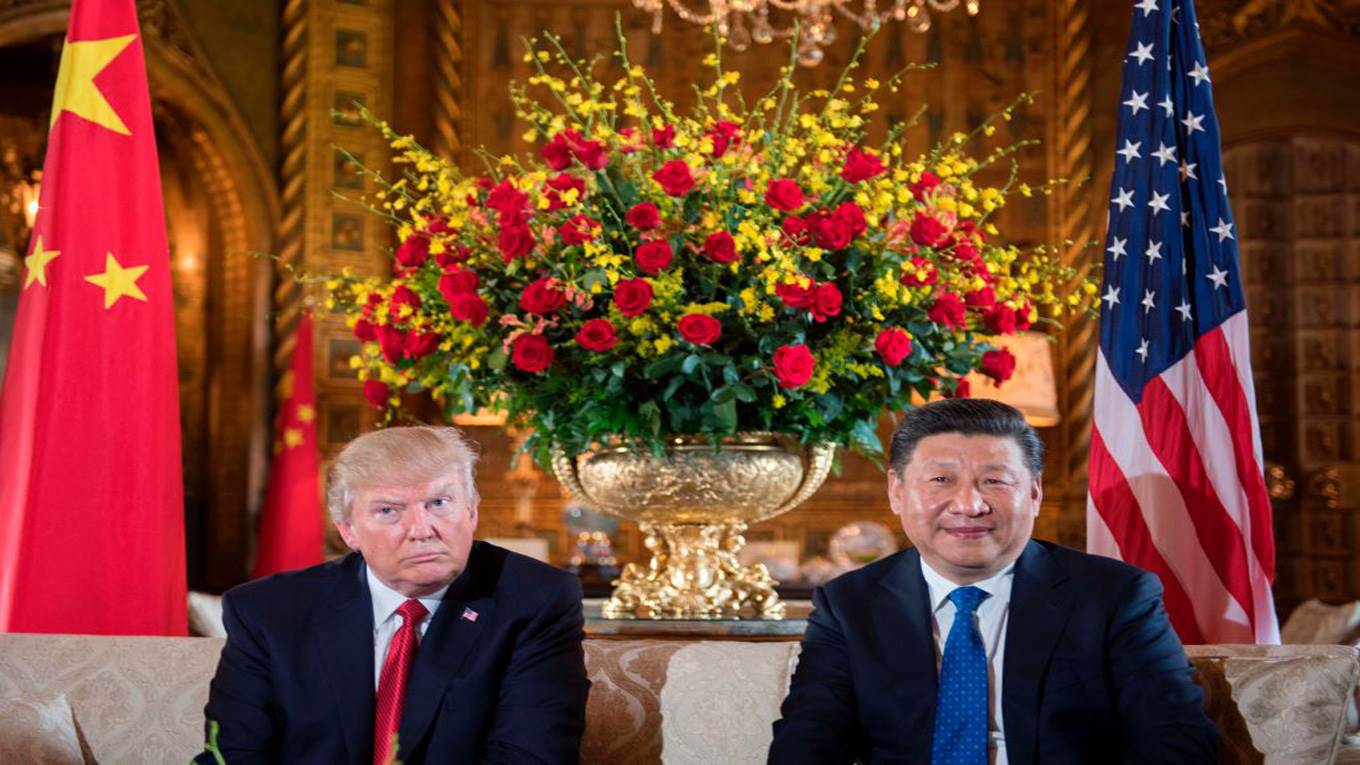

WASHINGTON, DC – At the G20 Summit in Argentina this weekend, US President Donald Trump will meet with Chinese President Xi Jinping to talk, above all, about trade. If their discussions do not go well, Trump could follow through on his threat to increase tariffs on a wide range of Chinese goods. But the stakes are even higher than that.

WASHINGTON, DC – At the G20 Summit in Argentina this weekend, US President Donald Trump will meet with Chinese President Xi Jinping to talk, above all, about trade. If their discussions do not go well, Trump could follow through on his threat to increase tariffs on a wide range of Chinese goods. But the stakes are even higher than that.

More broadly, Trump argues that the World Trade Organization has failed – for example, with regard to China – and that the United States should withdraw from the organization. Threatening to leave the WTO makes no sense even as a negotiating strategy, let alone as a policy, but it could still happen. The consequences for the US economy and for the world could be calamitous.

Ostensibly, Trump’s current priority in discussions with the Chinese is stronger protection for US patents and copyrights. On the face of it, this makes some sense: it is estimated that various forms of “theft” of intellectual property cost the US economy at least $225 billion (1% of GDP). Protecting intellectual property has long been an important part of US trade policy, as reflected, for example, in the Uruguay Round of negotiations that concluded more than 20 years ago. And there have been conspicuous cases of industrial espionage that allegedly involve Chinese companies (or perhaps some branch of the Chinese government) stealing trade secrets from firms with operations in the US.

But some of the most prominent American concerns about China’s intellectual-property regime today come from companies that want to invest in China, including the establishment of productive capacity there. China conditions these investments on technology transfer – a point highlighted by the US Trade Representative in a report released earlier this year, and now one of Trump’s talking points.

China’s insistence on technology transfer increases the short-term cost of doing business (for US and other foreign direct investors) and creates the threat of future competition from Chinese firms. Trump vows to “bring back” manufacturing jobs to the US. How does making it easier for American companies to manufacture and innovate in China contribute to fulfilling that promise?

Perhaps Trump’s agenda is the more conventional aspiration to “open markets” for US exports, and it is entirely possible that the Chinese will offer to buy more of some category of goods after the G20 summit. Trump likes headlines and most likely he would prefer a favorable news cycle or two, given the recent gyrations in financial markets. But such deals are typically meaningless – the goods were going to be bought anyway in some fashion.

A more likely outcome, at the summit or soon after, will be another lurch in US policy against the existing WTO framework. The US is already blocking the appointment of judges to a key WTO appeals court. If this continues, the WTO adjudication process will effectively grind to a halt, perhaps as soon as next year. This would be a major loss: the WTO’s dispute settlement process is essential to rules-based global trade. And, contrary to what Trump claims, the US wins far more often than it loses at the WTO. From 1995 to March 2017, the US prevailed in 91% of cases that it brought against other countries, according to data from the conservative Cato Institute.

But the US stands to lose a case brought against the Trump administration’s recently imposed tariffs on imported steel and aluminum, because they most likely violate WTO rules. So the White House now wants to undermine the WTO’s legitimacy and rescind US commitments to a multilateral trading system more broadly.

Could the US actually pull out of the WTO? Chad Bown and Douglas Irwin of the Peterson Institute for International Economics have written a careful analysis of the possibilities (I am also affiliated with PIIE, but I was not involved with this work). In their view, the power to do so more likely lies with Congress. But Trump certainly could issue a declaration of withdrawal, and then litigate his authority to implement it. Which way would the Supreme Court decide? It is very hard to predict.

And while that litigation continues, there would be great uncertainty about tariffs and much else. Bown and Irwin point out that, given how the system works, tariffs that are currently below 5%, on average, could jump to nearly 30%. There would naturally be retaliation in the form of higher tariffs imposed by America’s trading partners, which is exactly what happened after the steel and aluminum tariffs were imposed earlier this year.

There are definitely valid concerns about how China conducts trade, including what Pascal Lamy, a former WTO director-general, calls “opaque, trade-distorting subsidization of high-tech products.” But, as Lamy says, a more effective way to deal with this would be to strengthen WTO rules. Plenty of other countries would like to join the US in such an effort. Unfortunately, as in so many areas, Trump prefers unproductive

No comments:

Post a Comment