Jude Clemente

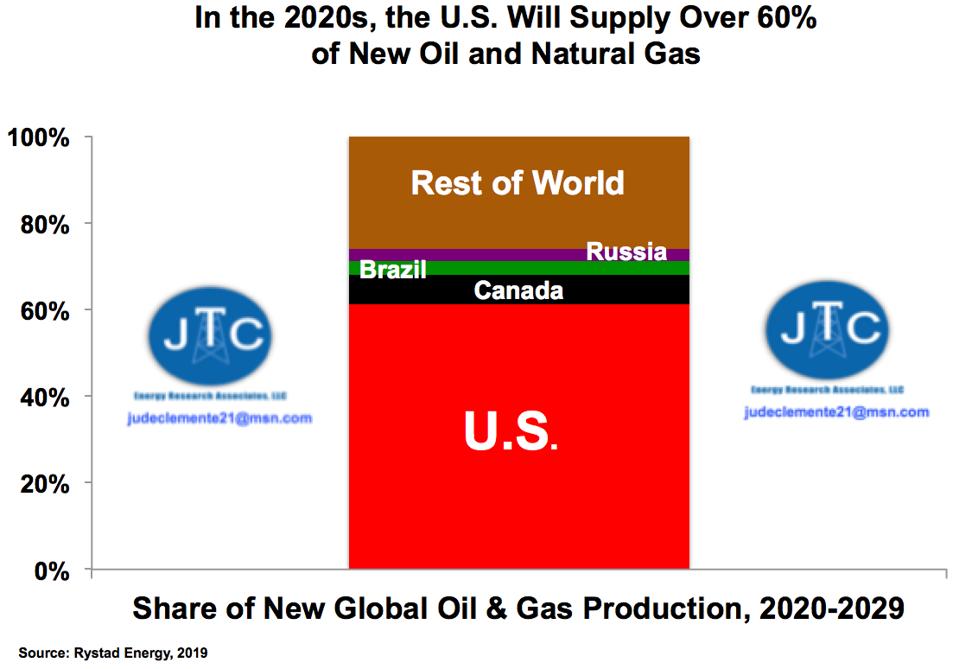

The American fracking for oil and natural gas boom will continue on through the 2020s. And why not? Since fracking took off in 2008, we have more than doubled our proven oil reserves to ~65 billion barrels. Natural gas reserves have surged over 80% to ~430 trillion cubic feet. Already the largest oil and gas producer, the U.S. is set to increase its share of ~17% of global oil production and ~23% of gas. In the 2020s, the U.S. is set to supply over 60% of new oil and gas (see Figure below).

This is according to experts at Rystad Energy, “an independent energy consulting services and business intelligence data firm” based in Norway. Rystad says the U.S. shale industry will continue to mount production even if prices drop. The reality is that oil and gas companies already have. Oil prices have been sliced in half since the triple-digits seen in mid-2014, yet U.S. crude oil production has still jumped over 50% to nearly 13 million b/d. For 2019 alone, the weekly oil rig count has plummeted 25% to 663 rigs as of Friday, yet weekly output has risen another 1.2 million b/d. Natural gas prices have fallen 17% this year and gas rigs are down 34%, yet gas U.S. output has still risen over 10%.

As companies focus on “cash flow discipline and free cash flow generation,” Rystad says that even with an 11% reduction in shale oil investments next year, U.S. tight oil production alone will be closing in on 11 million b/d by 2022, up from 9.1 million b/d this month. This jump in shale output comes even as WTI prices fall to $54 in 2020 and 2021. For natural gas, although the associated gas supply coming from the Permian will help keep U.S. prices low, another 10% rise in U.S. shale gas output to above 100 Bcf/d is to be expected over the next two years. This means that we will soon be producing 50% more gas than Russia, just having passed it in 2009.

Indeed, Rystad’s bullish outlook for U.S. shale is hardly alone. The Paris-based International Energy Agency reported in November that the U.S. will supply 85% of the new oil and 30% of the new gas through 2030. The current bear oil and gas market will not last forever - nothing ever does. Surviving through the pain of lower pricing, the industry has so sharpened its knife that higher prices will offer drastically easier times.

Today In: Business

Ultimately, 1) oil having no significant substitute, 2) gas rising toward being 50% of all U.S. power capacity, and 3) a surging export complex to export both fuels ensure that our massive resource base will be developed. Simply put, those pushing divestment should realize that it obviously cannot work: divestment does nothing to reduce demand.

The U.S. will extend its lead in oil and gas production in the 2020s. DATA SOURCE: RYSTAD ENERGY; JTC

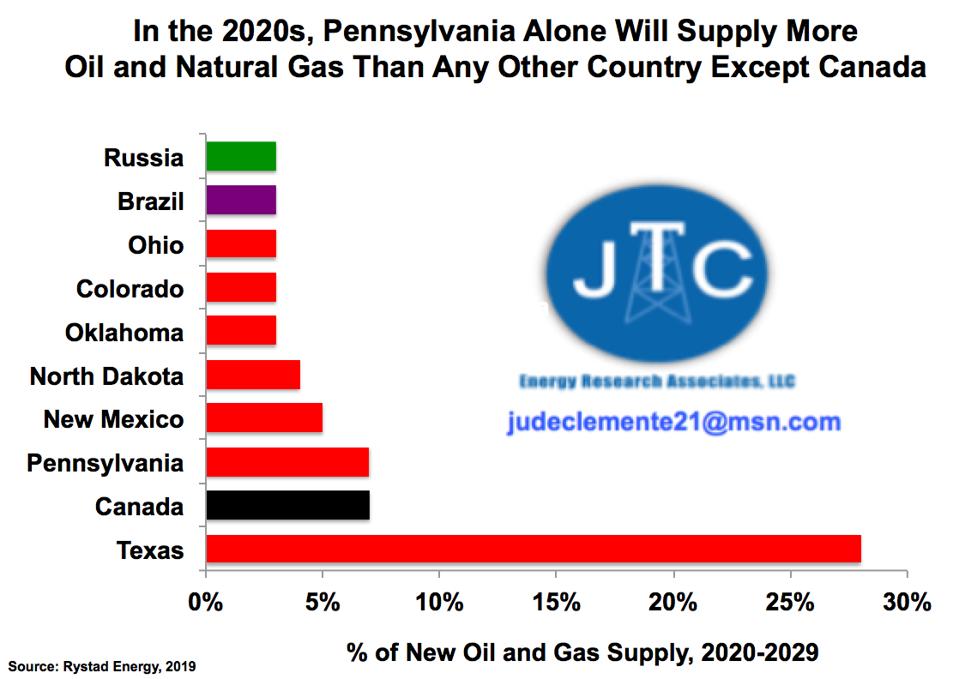

So when looking at the individual U.S. state level, the ongoing rise of our shale oil and gas output is staggering. All presidential candidates should think about this: in the 2020s, the state of Ohio alone is expected to add as much oil and gas to global supply as Russia (see Figure below). This is our greatest geopolitical leverage and not-so-secret weapon: shale not only made us the world’s largest oil and gas producer but will make us the largest seller in just a few years. Next year, the U.S. Department of Energy reports that we will become a net exporter of oil on an annual basis for the first time ever.

Vladimir Putin knows that U.S. shale production and surging associated exports are throwing a big wrench into his grand strategy of energy domination. Russia’s position as the largest oil and gas exporter rakes in over $300 billion each year. No wonder then that Putin has been funding NGOs whose job is to persuade governments to stop shale development. “Without Fracking For Natural Gas, The U.S. Loses And Putin Wins,” making anti-shale positions the real “Russian collusion” story.

The clear reality of mounting global demand for oil and gas explains why Russia is advancing oil and gas interests with China, the Middle East, Latin America, and Africa. Further, Rystad reports that Russia’s Gazprom (+1,200,00o boepd) and Beijing’s PetroChina (+ 730,000 boepd) were easily the two largest suppliers of new oil and gas from 2014 to 2018. We unquestionably must counter this or we will be handing irreplaceable and growing markets to rivals.

As for the “end of shale,” be....very careful with that. You should know that not even the industry itself ever saw the revolution coming in the first place. I really do think, however, that the next energy revolution could be CO2-EOR, for which we have literally hundreds of billions of barrels of oil in mature fields primed for development, while also storing CO2 safely in the ground to cut emissions. Now yielding ~450,000 b/d, the industry itself does not promote CO2-EOR nearly enough. But to its credit, the Natural Resources Defense Council calls CO2-EOR a win-win-win for our environment, energy, and economy.

Individual U.S. states are supplying more new oil and gas than entire major producing nations. DATA SOURCE: RYSTAD ENERGY; JTC

No comments:

Post a Comment